Last month Statistics Jersey released estimates on the size and performance of Jersey’s economy in 2022.

This statistical release included a number of improvements to the way the estimates are calculated (The size of Jersey’s economy is measured through gross domestic product (GDP) and gross value added (GVA), which measure the value created by producing all the goods and services in the whole economy, and individual sectors, respectively.).

These changes mean we now have more data on Jersey’s economy; but, as with any change, they do require users to invest a bit of time in understanding the changes and how best to use and interpret the new data. This note will try and do that. It will also consider what the 2022 GDP data tells us about the health and performance of Jersey’s economy.

Credit and huge thanks must go to Statistics Jersey for their work and continual investment in developing richer statistics, and for helping users such as the Economics Unit develop an ever better understanding of Jersey’s economy. Of course, the analysis and interpretation of the statistics is the work of the Economics Unit.

In 2022 Jersey’s economy performed largely as expected…

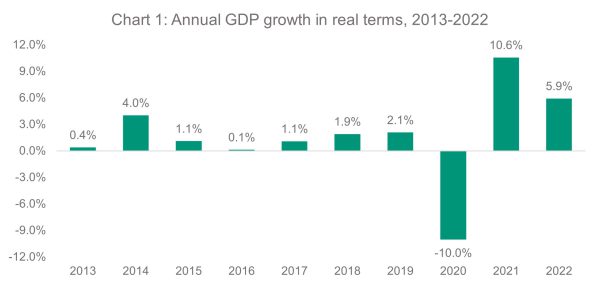

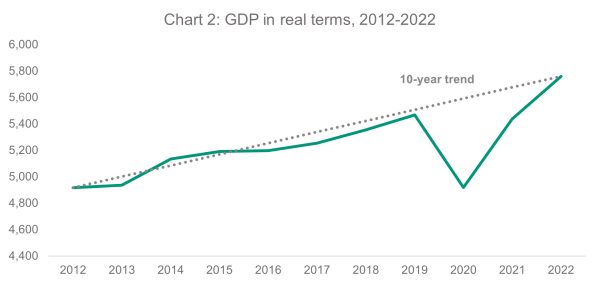

Last month’s statistical release showed that Jersey’s economy was worth £5,761 million in 2022. This was an increase of 5.9% in real terms compared to 2021. “Real terms” means after adjusting for the differences in prices between the 2 years (i.e., adjusting for inflation) and this is important as it allows us to see whether the economy has grown in size/value or whether the change is simply because of inflation.

The same release also showed that over the last 10 years, real GDP has increased by an average of 1.6% per year.

The Fiscal Policy Panel (FPP) – the group of eminent economists who advise the Treasury and Resources Minister on Jersey’s economy – forecast that Jersey’s economy would grow in 2022 by between 4.3% and 8.7% (March 2023 and July 2023 economic assumptions). Given the inherent difficulty and uncertainty in forecasting, their forecast was not that far off outturn. The FPP also said that growth would be driven by the financial services sector which would benefit from the higher interest rates set by the Bank of England. The data from Statistics Jersey confirms this: the financial, legal and accounting sector grew by 18% (real terms) to £2.4bn. In growth terms, only the accommodation and food services grew by more (+25%) as it bounced back from the pandemic but at just 4% of the total economy, the growth of this sector has a small impact on the size of the economy.

…and the changes in the statistics mean we can better understand how the various sectors of Jersey’s economy performed.

As mentioned above, Statistics Jersey have made some changes to the way they estimate the size/value of Jersey’s economy. One significant benefit of these methodological changes is that there is more detailed data, which means that we now have statistics on 31 sectors (rather than 11 previously). In turn this means that users of the statistics can build a more detailed and sophisticated understanding of Jersey’s economy. (These methodological changes include a reclassification of businesses to sectors and sub-sectors. This gives us more detailed data, but has also meant that some businesses have been reclassified which in turn means that SIC2007 and SIC2003 data are not truly comparable. However, Statistics Jersey have reproduced 2021 data on SIC 2007 basis so we can compare 2022 with 2021. Another methodological change is that the estimates are now provided at market prices (adjusted for the impact of taxes and subsidies and the impact of FSIM (Financial Intermediation Services Indirectly Measured). Together these changes produce much better and more detailed data. GVA at market prices, summed across all sectors of the economy, equals GDP – this was not previously the case for GVA estimated at basic prices.)

As an example, Financial Services is now broken down into 4 sub-sectors, allowing us to better understand how the sector is performing

For the first time, we can see how sub-sectors of Financial Services perform, and perhaps more interestingly we can identify the effect of interest rates on the output/value and productivity of these sub-sectors.

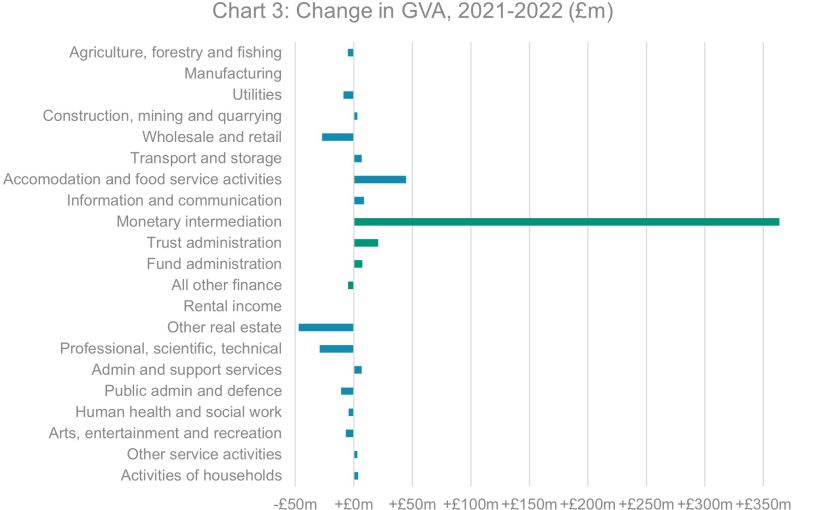

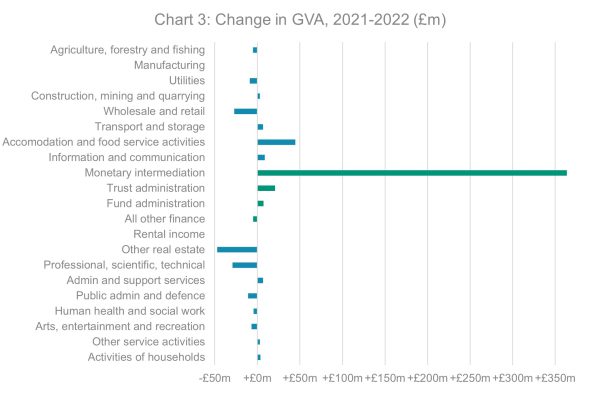

As you can see from Chart 3 (above), growth in Jersey’s economy was primarily from the monetary intermediation sub-sector (more commonly known as banking), with growth and contraction in the other sectors/sub-sectors largely cancelling each other out. We also know that the growth in the banking sector was driven by interest rate changes – i.e., factors external to the sub-sector – with interest rates rising from 1.75% (August 2022) to 3.5% (Dec 2022).

And we also have data on employment by sector and sub-sector…

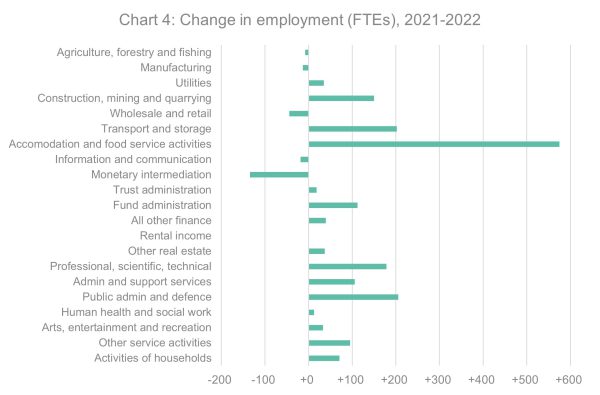

The GVA/GDP statistical release also includes data on employment by sector and sub-sector. Employment is presented as full-time equivalents (FTEs) – a commonly used method that converts total hours worked into a number of full-time workers to enable standardised comparisons over time, between countries and accounting for different working patterns. This data is shown in Chart 4 (below).

This data tells is that there were an additional 1,600 full-time equivalent workers on Jersey compared with 2021. This itself is interesting – and should debunk any suggestion that there has been a net emigration of workers from Jersey. (The latest labour market statistics further support this picture, with the highest number of jobs on record reported. Although jobs are not the same as people in work (as people can have multiple jobs), this is consistent with further net migration of workers to Jersey.)

What is also interesting is that the hospitality sector (comprising accommodation and food and beverage services) saw the greatest increase in employment at + 585 FTEs (or 12%) and a 12% increase in GVA; whilst banking saw the greatest increase in GVA (+47%) and a fall in employment.

…combining the two tells us about productivity growth… or otherwise in 2022.

Productivity increased by 5.0% in real-terms. This sounds impressive and in some ways it is. However, looking beneath the figures reveals a less rosy picture.

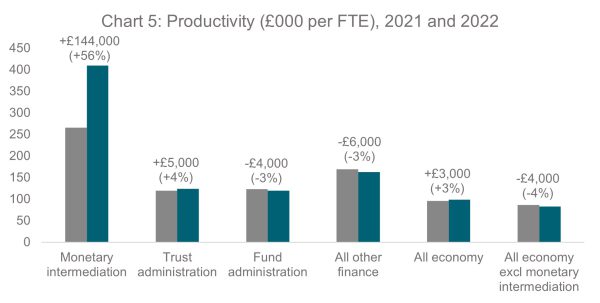

First, the increase in productivity was driven by increased profits in the financial and insurance activities sector, and more specifically in the banking sub-sector. In turn this was driven primarily by the increase in interest rates. Productivity in the rest of the Financial Services sector was, at best, flat (see Chart 5 below).

This is also interesting as it provides further evidence that interest rates (or more specifically low interest rates) are not the only reason for declining productivity in the financial services sector.

Second, excluding the financial services sector, productivity declined by 4%. This fall in productivity reflects the fact that employment increased (+1500 FTEs, or 3%) whilst output was unchanged.

Looking forward, the prospects for Jersey’s economy over the next year are mixed. The latest data from the Business Tendency Survey was neutral across all sectors for business activity, indicating no change in total work undertaken in Q3 2023 compared to the previous quarter. Businesses in financial services report greater optimism about present and future business activity, while the outlook for input costs is extremely negative across all sectors.

The latest data on inflation is also mixed. Headline inflation (RPI) in the twelve months to September 2023 was 10.1%, down from 10.9% the previous quarter and in line with the FPP’s forecast. Stripping out the impact of mortgage interest payments, (this is a more relevant measure of inflation for households without a mortgage, or for households on a fixed-rate mortgage) the RPI(X) measure of inflation was 5.4%, down from 6.1%. Although inflation is slowing, largely due to easing food and drink prices, prices in Jersey continue to increase more quickly than we would usually expect – and UK inflation has been “stickier”, i.e., been higher for longer, than initially expected, which is likely to have a knock-on effect for Jersey. High inflation can suppress real terms economic growth, as people and businesses find it more difficult to plan for the future and afford the goods and services they usually would buy.

Looking over the longer term, high inflation will subside, with the FPP forecasting RPI inflation of 5.3% over 2024, and 0.8% over 2025. The rising interest rates associated with high inflation boosted Jersey’s economy overall in 2022 through monetary intermediation – but growth elsewhere is weak. Jersey’s economy has, over the last decade, grown solely because of growth in the workforce (enabled by higher net migration and population growth). This isn’t sustainable and so collectively we need to find ways of increasing the output per worker (productivity). This is the aim of the Future Economy Programme.

blog.gov.je

blog.gov.je