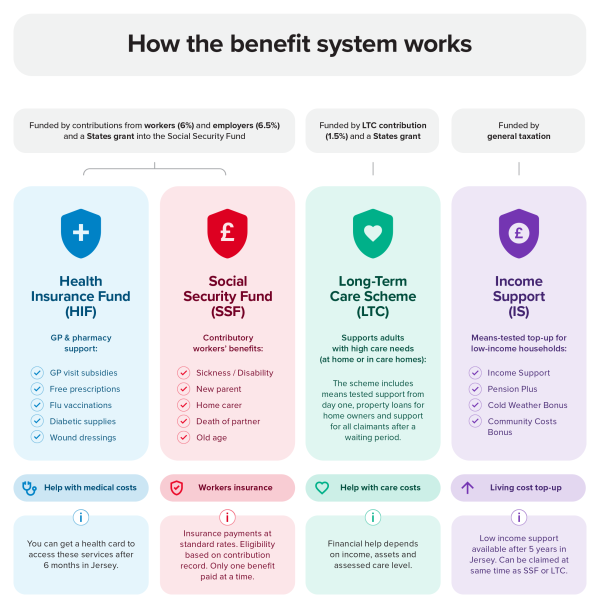

Ever wondered how Jersey’s benefits actually fit together? Whether you’re working, have just become a new parent, or are planning for retirement, these schemes are designed to support you through life’s changes. Each has its own purpose, but they also complement each other to create a safety net. Here’s what you need to know.

Social Security Benefits – Your “Workers’ Insurance”

Think of this as an insurance policy for workers. It’s funded by contributions from both employees and employers as well as the States grant (this is the amount taxpayers pay into the Social Security Fund). All adults in Jersey under pension age are included in the scheme, and most pay into the scheme every month. Employees pay in 6% of their earnings up to a standard earnings limit of £5,800 a month, while employers pay 6.5% of wages up to the same limit and an extra 2.5% on employees’ earnings between £5,800 a month and an upper earnings limit of £26,442 a month.

These contributions fund weekly contributory benefits. Working age benefits include sickness allowances, parental benefits, home carer’s allowance and survivor’s benefits. The old age pension is paid when you reach pension age or choose to claim your pension early.

Value of Contributory Benefits

Contributory benefits provide a fixed weekly payment to help support you at times when you can’t or are less likely to be able to work. The amount received is based on standard rates that are increased each year. Standard benefit rates are just under £300 a week in 2025.

The amount also depends on the contributions that you have paid in to the system. Only one benefit payment is made at a time. For example, you do not get two payments in a week if you are off work and claiming parental allowance and then you also have a short-term illness that would qualify you for a sickness allowance. The value does not depend on how much you normally earn, and it does not depend on any other income that you are receiving.

Working-age benefits stop when you start to claim your old age pension.

A unique exception exists for carers who are already receiving home carer’s allowance. At pension age, they can choose to carry on claiming their HCA or move to their old age pension, whichever they prefer. If the carer does not have a full pension record, they may wish to continue to receive the HCA amount.

Health Insurance Fund – Help with GP, Prescriptions and More

Also funded through Social Security contributions, this scheme helps reduce everyday healthcare costs. With a Social Security health card, GP consultations are subsidised by £50.28 per visit, a wide range of prescriptions are free at community pharmacies, and items like flu vaccinations, diabetic supplies, and wound dressings are covered too.

The HIF also supports low-income families who pay low, fixed fees for GP services through the Health Access Scheme and provides free GP surgery visits for children and full-time students.

Income Support – A Means-Tested Top-Up

Income Support is a separate benefit system that does not rely on contributions. It is funded by taxpayers and supports households with a low income. The amount provided depends on your household’s income and needs and acts as a top up to ensure basic living standards. The number of adults and children in the household, accommodation costs, childcare and disability are all taken into account. You can receive Income Support at the same time as a contributory benefit, but the contributory benefit will be included as part of the income calculation. Homeowners can receive income support as well as tenants.

Other means tested benefits include:

- Pension Plus which supports dental, optical and chiropody checkups and treatments and the Cold Weather Bonus which provides payments in line with winter temperatures. These schemes are only available to pensioners.

- The Community Costs Bonus supports eligible households with an annual lump sum payment.

Long-Term Care (LTC) – Support for High Care Needs

If an adult needs significant care, the LTC scheme helps cover costs for care at home or in a care home. It’s funded by an LTC contribution, that is collected as part of your ITIS or income tax bill, and a States grant. The amount of support available depends on your income, assets, and assessed care level. The LTC scheme includes a waiting period for households who can afford to meet their own care costs for a time. Households with lower incomes and limited savings can receive financial support from the start of the care package,

The scheme includes property loans so that homeowners do not need to sell their home to help meet care bills.

You can receive LTC benefit at the same time as a contributory benefit or Income Support.

How They Work Together

These schemes complement each other. Social Security contributory benefits provide standard benefit payments during times when you are less likely to be working. The Health Insurance Fund reduces healthcare costs for everyone with a health card. Income Support fills gaps for households with low income. And Long-Term Care ensures people with high care needs get support without losing their home.

Together, they form a safety net that adapts to life’s changes.

Need Help?

Not sure what benefits you’re entitled to? Contact Employment, Social Security & Housing for guidance by:

- Visiting the team at Union Street, between 8:30-5pm , Monday – Friday. You can check the current wait times at gov.je/ESSHwaitingtime

- Pre booking an appointment online at gov.je/essh

- Calling 01534 444444 between 8:30-5pm Monday – Friday

- Online at gov.je/essh

Getting the right advice can make a big difference.

blog.gov.je

blog.gov.je