About the author: Neil Sontakke was commended in the Future Economists Essay Competition 2024.

Neil answered Question 2: The International Monetary Fund (IMF) estimated that global inflation increased to 8.8% in 2022, driven by rising food and energy prices. What does economic theory tell us about what actions and initiatives the Government of Jersey might introduce to deal with the consequences of high inflation and cost of living?

Future Economists Essay Competition 2024: Commended

To the Chief Economic Advisor,

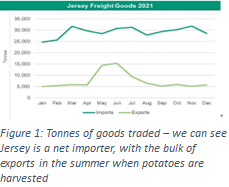

According to Jersey’s Export Strategy, overall, Jersey is a net importer of freight goods, withdrawing money from the circular flow of income and proving make independence difficult and inflation rates rising, which can be attributed to rising food and energy prices.

The cause for the increase in food prices can be attributed to the overreliance on Condor Ferries as a freight carrier. Condor is currently the only firm carrying goods overseas between the UK and Jersey, due to this lack of competition, there is no reason for Condor to bring down shipping prices and so the price of food and shipping increases greatly. We see this dependency very often, especially when there are extreme weather conditions, such as Storm Ciaran, where there was a large pressure put on shops.

Condor reportedly increased freight charges by 18% at the end of 2023, but there is no one to stop them as they are the only shipping company going to and from the UK and the EU. Monetary policy, which is typically used when dealing with rises in inflation rates, can be put in place. It just needs to affect the right firms. By reducing the operating cost for firms wanting to move goods, inflation could be reduced on imported goods. However, this lowers chances of any other companies wanting to enter the market, reducing competition. This is talked about more later. Another potential problem that can occur is a distortion in the price mechanism. Since the price is artificially changed, as opposed to the ‘invisible hand’, there may be a shortage of ferry services, show by the difference between Qs and Qd. The cost cap could cause unemployment as well. Since prices come down, Condor may not be able to employ as many staff as it currently has. This could result in a significant under provision of freight services and firms may have to wait longer for their goods since there could be less sailings because of falling profits.

While price controls may be beneficial, there are significant risks that would need to be given deep consideration. It does not help that there is no competition for Condor, which brings us onto my second solution:

A new freight company

ITV reports DFDS, an ‘Established ferry operator’ may consider a bid for the operating agreement. If this goes ahead then Condor will finally face competition in the freight market. DFDS has clearly shown their interest as they have attempted to dock their significantly larger boats in Jersey’s ports and were successful.

DFDS also have a wealth of experience, over 100 years over Condor. There is no doubt that they would be able to deliver in the same way as the current suppliers. Perhaps, they may be more successful.

With Condor’s operating agreement with the government coming to an end in 2025, an opportunity is presented to DFDS to bring competition into the freight transport industry. By introducing a rival to Condor, they then have incentives to drive down prices and provide a better quality (dependable, quick transport) to become the favoured freight company for Jersey.

What would be best is to allow both firms to operate, meaning there is direct competition between them and supply to the island is not limited at all. What may be ambitious is asking one firm to specialise in freight services and the other to specialise in transportation for people. This would lead to specialisation, lowering costs further as output increases (figure 2). In addition, firms can sell their goods for less than they currently do. Of course, they could sell at the same prices for higher profits, however, policies can be introduced to bring prices down, such as maximum prices for goods, the benefits of which have already been discussed.

Rising Energy Costs

In terms of rising energy prices, which have seen a 12% increase in energy costs. This comes after increasing ‘operating and importation costs’ that had to be passed on to consumers. Capital costs are higher for nuclear energy, which makes up 62.7% of the island’s energy. This is due to the costly controls and special equipment needed to ensure safe running of the power plant. But what can we do about rising gas prices, when 95% of our energy comes from hydro sources and nuclear power in France?

A maximum price will create excess demand but ensures consumers can avoid a higher percentage of their real income going towards necessities, ensuring a good quality of life. The downsides will also have little effect as they are still making the same profits as before, but the consumers are more well off as a result.

However, this reduces the profits for Jersey Electricity, meaning their reasons for pushing costs up (capital costs rising for infrastructure) only gets worse. This suggests the government may need to increase the subsidy granted to Jersey Electricity. In 2021, Jersey spent £46,085,000 on infrastructure, where previously the budget was £64,084,000 two years before. By increasing the subsidy given to Jersey Electricity, they can also cover a fraction of the relatively high capital costs of installing more solar panels and developing tidal farms, leading to Jersey becoming more independent and moving to our own sustainable energy.

In conclusion, most inflation-battling policies are monetary ones, such as a maximum price which has been mentioned several times in this essay. As long as the price controls in place are put in carefully with great consideration.

blog.gov.je

blog.gov.je