About the author: Seventeen-year-old Ayla Hussey entered the Future Economists Essay Competition 2024, where she was the runner-up, being highly commended by the panel of judges for his economic writing and understanding.

Alya answered: The UK Dasgupta Review of Economics and Biodiversity states that ‘Our unsustainable engagement with nature is endangering the prosperity of current and future generations’. What economic policies could Jersey introduce to protect and restore the natural environment?

Future Economists Essay Competition 2024: Runner-Up B

Dear Government of Jersey’s Chief Economic Advisor,

Today I will be writing to you about the economic policies that Jersey should introduce to protect the natural environment. As stewards of our planet, I truly believe that it is imperative that we recognise the importance of Government intervention in conserving our natural environment in Jersey. It is evident that in our society of heedless consumption, the promotion and propelling of sustainability from the Government will put us in the right shoes to embark on our green transition. The statement made by the UK Dasgupta Review of Economics and Biodiversity reflects how future generations will have to deal with the consequences of the decisions made by our society and how their ‘prosperity’ will become ‘endangered’.

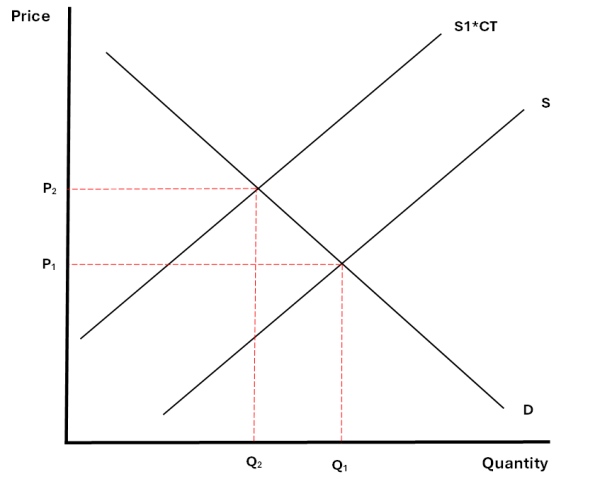

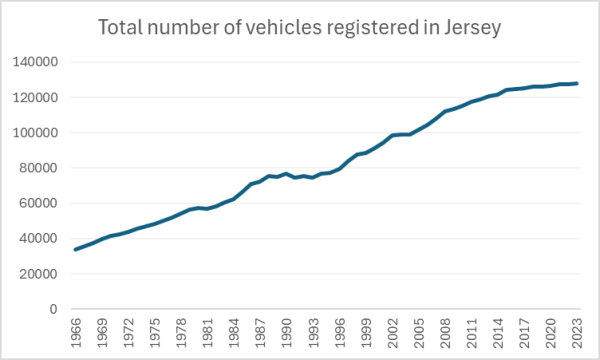

The first economic policy that could be implemented by the government is a carbon tax. A carbon tax can be defined as ‘a tax on fossil fuels, especially those used by motor vehicles, intended to reduce the emission of carbon dioxide into the atmosphere’. In simple terms, this means that there would be a charge placed by the government to reduce the amount of carbon emissions we inject into our airs. Nowadays, 86% of energy is made from fossil fuels and global consumption has increased by more than 50% since the 1990’s. The carbon produced creates a negative externality into society- it worsens the enhanced green house effect by trapping in more gases, therefore it is crucial for this tax to be put into effect on our island. The tax will have an effect on those who drive and contribute to the generation of carbon emissions from their vehicles. It’s evident that with an increasing number of vehicles registered in Jersey (Figure A) the carbon tax could be considered effective. The supply curve S1*CT (carbon tax) increases price to P2, thus sending out a signal to consumers that the market equilibrium point has shifted to P2Q2 (see diagram 1). Jersey’s inhabitants will have an incentivised behavioural change and reduce their carbon emissions as the tax has taken up a larger proportion of their income which they may not be ready to pay in a society with a high cost-of-living. Consumers are likely to have an inelastic demand for carbon (as it is a necessity) and therefore they will find a way to use their vehicles as normal but reducing their carbon intake- this may be through switching to electric vehicles (merit goods). This action will reduce the negative externalities into the environment from a reduction of carbon emissions and promote a more sustainable engagement with nature within society.

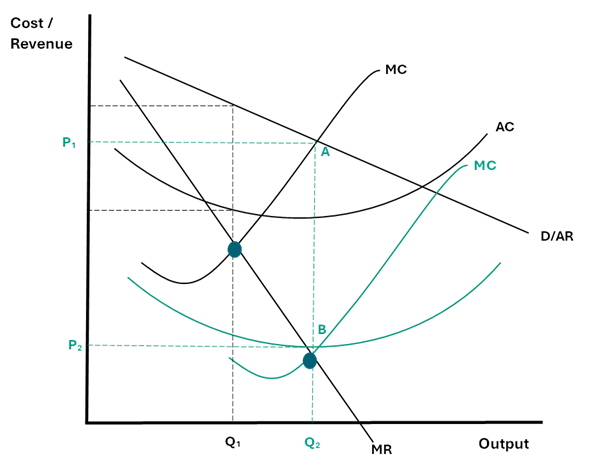

The second economic policy taken by the government could be to subsidise local firms or charities that promote the protection of the natural environment. A subsidy is a ‘government given grant to a firm that aims to increase supply to keep the price of the commodity low to encourage consumption’. In terms for Jersey, this subsidy given to firms may not only be given for this purpose but also to increase the funding for research and development programmes to increase innovation, thus creating more sustainable approaches to protect the environment. Currently, in Asia, there has been significant investment and innovation in vertical farming. This is the practice of growing crops in vertically stacked layers which optimises plant growth. The government’s investment into this will promote a more sustainable engagement with nature as it is energy efficient. The farms are designed with renewable energy sources such as solar panels that can protect the natural environment. This innovation will massively increase efficiency as on our 9 by 5-mile island, one main concern is land, which becomes more scarce as time goes on. By offering this plan, our island can save over 90% land and 70-95% less water. These goods create a positive externality into society as they will create healthy crops with no fertilisers (which we consume), creating an all rounded healthier and more sustainable community and will increase long-run aggregate supply (LRAS) for this market. Additionally, another benefit of vertical farming granted to producers would be a decrease in labour costs. These farms require little vigilance and therefore the firms don’t need to be paying workers as much money, thus reducing their average costs. This allows the firm to make larger profit margins (as we assume that firms profit max at point MC=MR) and make supernormal profits at point P1P2AB (see diagram 2) which can be used to reinvest into more innovative programmes to progress the economies sustainable engagement with the environment. Vertical farming will not only be a worthwhile investment for a short-run period of time will be an invaluable resource in the long run for Jersey. Estimates say that 700 hectares of farmland can be condensed into a supermarket-sized building with vertical farming- making it a high-value investment for the Government of Jersey.

In conclusion, I believe that there is a crucial role the Government of Jersey can play in order to ‘protect and restore the natural environment’ in Jersey to aid us onto our green transition pathway. Once, as a community, we have reached those pre-conditions for transition take-off, then there is no doubt that Jersey will have any further issues with an ‘unsustainable engagement with nature’, as long as there are no negative external interruptions into the system. Sincerely, Diagram 2- a cost/revenue diagram for the firms innovating in vertical farming.

blog.gov.je

blog.gov.je